Let’s face it: most people don’t join startups strictly in pursuit of the highest salary on the market – they join in pursuit of the “Silicon Valley dream” – equity worth millions.

Whether you’re a recruiter, hiring manager, or founder, trying to sell this dream to candidates poses many challenges.

No one can predict the future, but it’s important to give your candidates and employees the tools to understand the value – and potential value – of this often misunderstood piece of compensation.

Common questions that often go unanswered for candidates and employees:

- What does it mean for me if my company becomes the next “unicorn?”

- How does the vesting schedule impact how much equity I receive?

- What piece of the company do I hold, and how meaningful is it?

Our goal at Pave is to empower you to communicate compensation transparently and have a consistent message around equity. It’s important not to over-promise the potential upside, but making your employees partial owners of the business through equity should help you win and retain top talent.

So we’ve put together a free option grant calculator to help employers demystify equity for current and prospective employees.

As a recruiter or people leader, you can share it with both employees and candidates to paint a clear picture of how their equity can be a life-changing part of the total compensation package.

And as an employee or candidate, you can gain a better understanding of what your equity could mean if your company were to have a 10X outcome.

About the Calculator

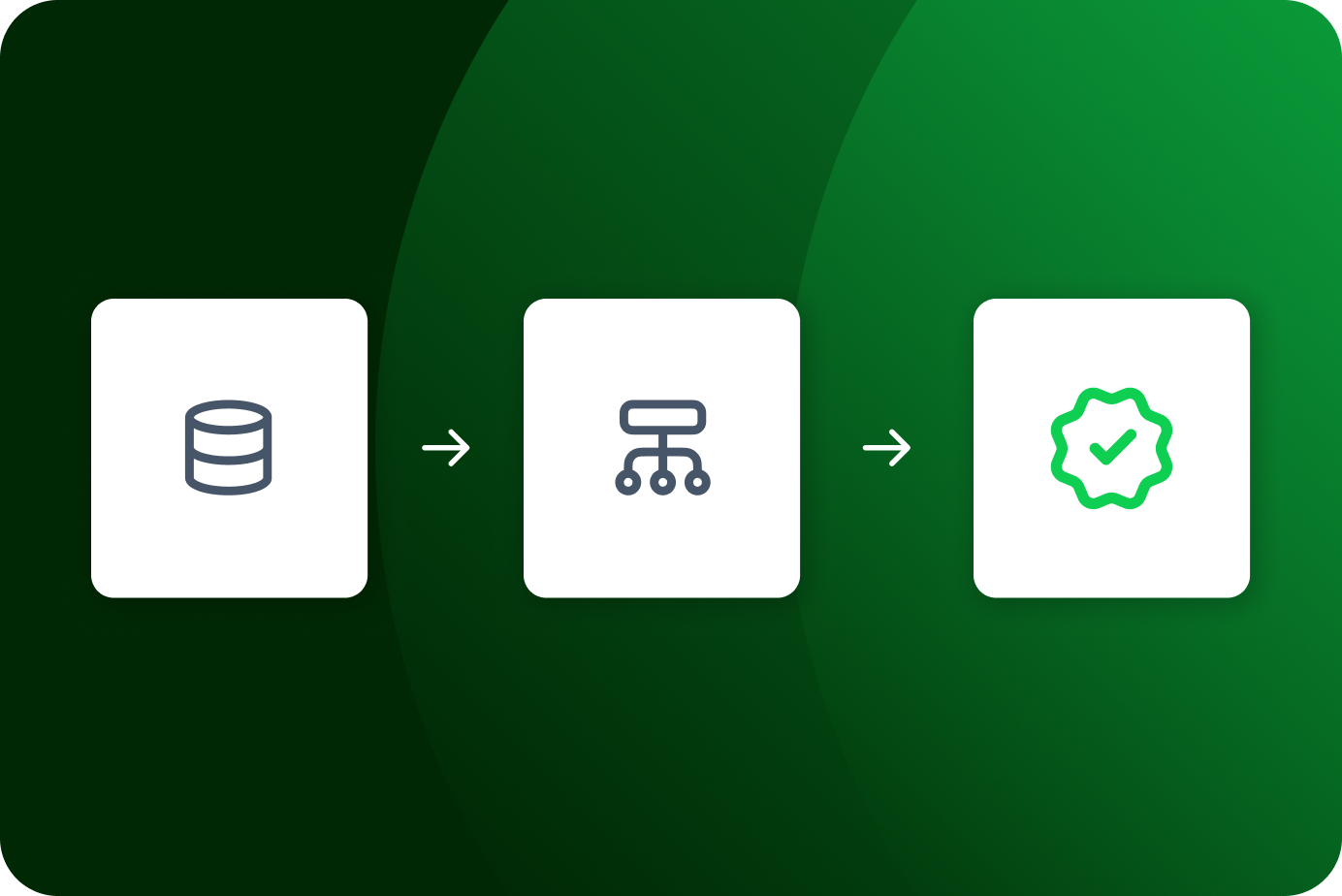

There are a couple key steps for how to use our equity calculator.

- Enter in the number of shares the candidate/employee holds (which you can find in the job offer letter).

- Input your most recent preferred price as well as the strike price for this grant. Enter in the company’s current valuation (most folks use their most recent funding round).

- Confirm you operate on a 4-year vesting schedule (this calculator assumes 4 year monthly vesting with a 1 year cliff)

- Model various growth scenarios (feel free to build out additional multiples based on potential outcome for your specific company).

DOWNLOAD THE CALCULATOR

Disclaimer: You can model our theoretical share price using this tool. However, it’s important to remember that the ultimate share price is still unknown and could increase or decrease based on our performance and market conditions.

This modeling tool does not take into account dilution from future rounds of financing nor does it consider the preference stack in the case of a liquidity event. Lastly, it assumes that the ultimate common share price and preferred share price will converge when a liquidity event occurs.

The information provided is for informational purposes only by Trove Information Technologies Inc. DBA Pave. Pave does not provide tax, accounting, or legal advice. You are advised to consult with your tax, accounting, or legal advisors regarding any financial, tax, or legal implications regarding your option grants. Pave does not assume any liability for reliance on the information provided herein.

Took an early retirement as a CPA to pursue a career in sales. Equity nerd. Compliance lens. Carta expert.